Savings Tool

Overview

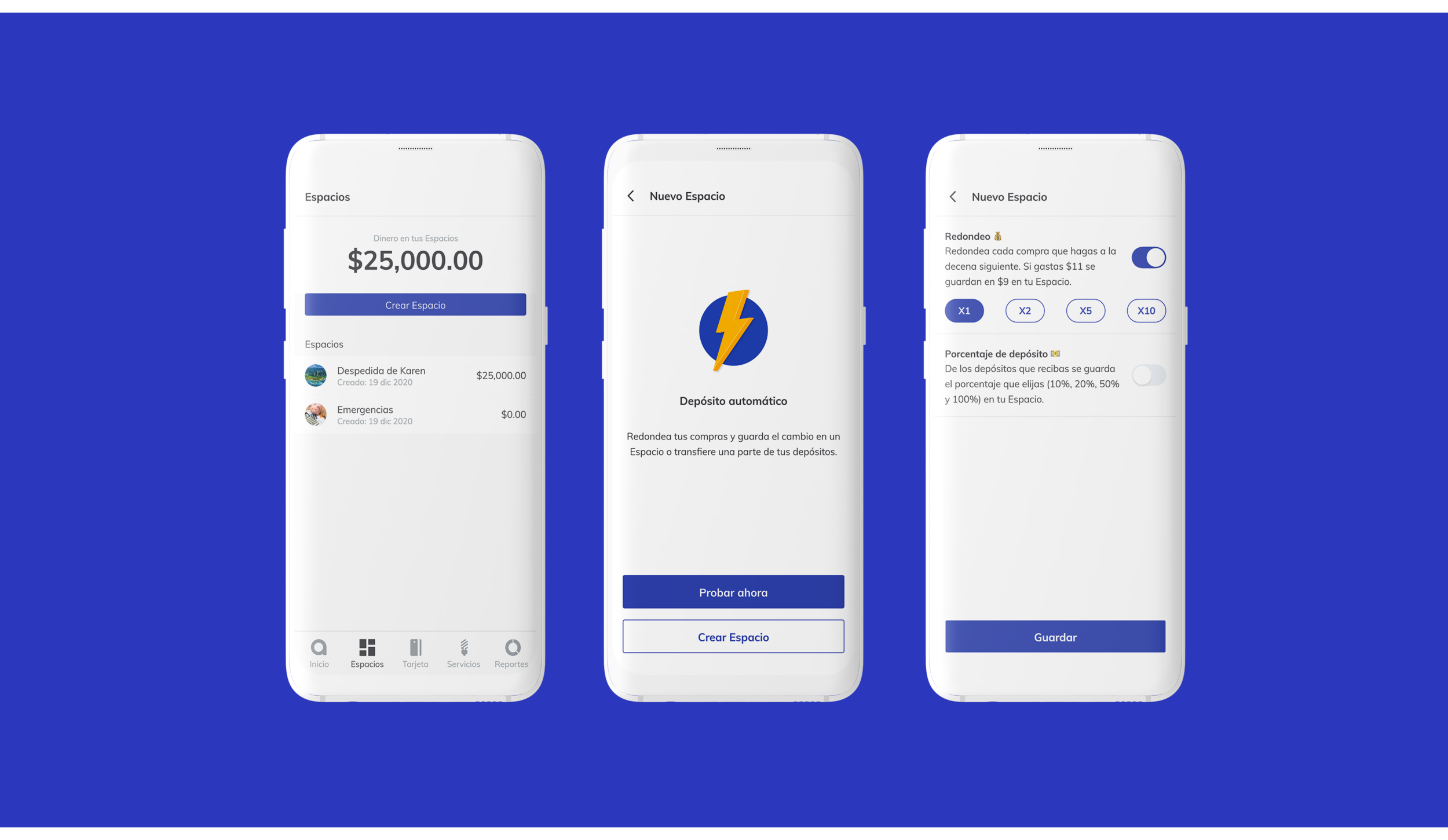

albo's debit card offered a unique value proposition: the Espacios savings tool. This tool allowed users to create subaccounts and segregate their funds, ensuring dedicated savings goals wouldn't be accidentally spent through everyday purchases.

Role & Duration

Product Design Lead, spearheading the project for 8 months.

Problem

Despite its potential, Espacios wasn't achieving desired adoption. Our mission was to increase the Average User Money (AUM) within Espacios by at least 15%.

Solution

To tackle this challenge, we partnered with Duke University to leverage behavioral science expertise and understand albo users' saving motivations. Through surveys and interviews, we identified two key strategies:

Targeted Messaging: At crucial moments, users received personalized messages highlighting the importance of saving for emergencies, a primary motivation identified in our research. This aimed to nudge them towards utilizing Espacios.

Automatic Savings Tool: We introduced "Round Up," an automated tool that deposited a small amount into an Espacio every time a user made a purchase. The Kano model, implemented through iterative surveys, helped us define the optimal "Round Up" experience.

Challenges

Pinpointing the starting point proved challenging. While the goal (increased AUM) was clear, determining the initial baseline metrics to measure success and identify areas for improvement required thorough analysis.

Disclaimer: Due to confidentiality agreements, some details of this project may be omitted or generalized. Please contact me directly for further information.